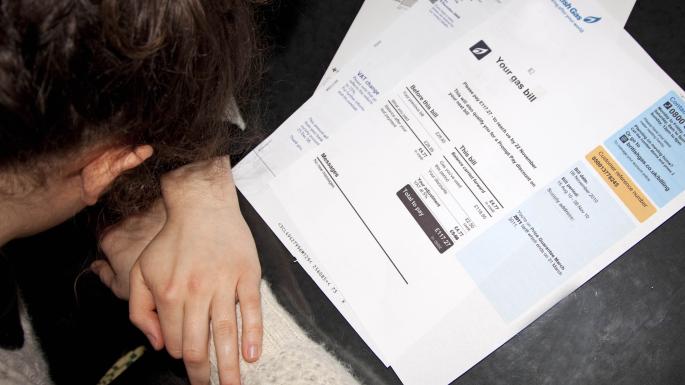

People in severe debt will be given a six-week “breathing space” to get their finances in order, under government plans.

The announcement comes a week after the Financial Conduct Authority (FCA) revealed that 4.1 million adults are in difficulty because they have failed to pay domestic bills or have missed credit payment, with many resorting to high-cost credit such as payday loans.

In the summer unsecured credit — which includes credit cards and overdrafts — exceeded £200 billion for the first time since the financial crisis.

A rise in interest rates, which could be triggered next week by the Bank of England, could prove the final straw for millions in debt.

The Treasury said that the idea behind the proposal was that during a financial “time out”, those with problem debt would be protected from enforcement action, would not have extra interest charges added to their debts and would have time to seek advice and put together a repayment plan. A spokeswoman said: “There would be no question of bailiffs at the door.”

The Treasury is launching a consultation until January on how the scheme should work, how long the period of grace should be and how problem debt would be defined.

Stephen Barclay, economic secretary to the Treasury, said: “We are working to give people overwhelmed by debt time to seek advice, find a workable solution and get their lives back on track.”

The new scheme could include legal protections that would shield individuals from further credit action once a plan to repay their debts was in place.

Charities and debt advice groups gave the plan a cautious welcome. Gillian Guy, chief executive of Citizens Advice, said: “We are seeking a ban on unsolicited credit increases and want the FCA to step in sooner when someone is struggling to pay their debts.”

Adrian Hyde, president of R3, the insolvency trade body, warned against a breathing space longer than six weeks, as lenders would be worried about how long it might take to recoup debts and might be less likely to lend.

Jane Goodland, business director at Old Mutual Wealth, the wealth manager, said: “These measures are admirable and will help protect vulnerable consumers. To tackle the root cause we need an effective programme of financial education integrated into the primary school curriculum.”